Motorcycle Insurance In Ontario: How to Get the Best Rate

Ontario, Canada

The subject of motorcycle insurance unifies riders in Ontario. Relative to automobiles and other leisure vehicles, motorcycle insurance has always been expensive here.

A few years ago we posted an article comparing motorcycle insurance rates in Ontario. It covered a few bikes and went into the realities of why motorcycle Insurance in Ontario remains so expensive. Since 2013, motorcycle insurance rates in Ontario continue to rise.

It's almost 2018 and while many of us are still out riding the cold pavement, it's time for another motorcycle insurance comparison, this time, with different bikes - Yes!

The Bikes

The low displacement, entry level bike is a 2015 KTM 390 Duke; the Cruiser is a 2017 Harley-Davidson Sportster XL 883L Iron; the 'around towner' is a 2015 Ducati Scrambler Sixty2 399cc; the popular sport bike is a 2014 Yamaha YZF-R6 600c; the big, bad tourer/high-ender is a 2014 Ducati Diavel Strada 1200cc; the rarity/litre bike is a 2009 Buell 1125R and the bonus is the 2017 Honda MSX 125 Grom. Let's get the party started.

Low Displacement Entry Level Bike - 2015 KTM 390 Duke $4,750

A few years ago, the manufacturers were all racing to produce lower displacement motorcycles to appeal to newer riders. KTM took their time and made the meanest entry level bike.

2015 KTM 390 Duke

The Cruiser - 2017 Harley Davidson Sportster XL 883L Iron $10,799

The Iron 883 has a light frame, a peppy engine and is comfortable to ride. It’s not "the entry level Harley”; it’s good for new riders, returning riders and older riders. This is one of H-D best-selling bikes, that's why I've included it in our comparison.

2017 HD Iron 883

The Around 'Towner' - 2015 Ducati Scrambler Sixty2 399cc $7,500

Even though the displacement puts the Scrambler at the lowest end of Ducati's offering, the Scrambler Sixty2 doesn't have to be your entry level bike. Its nimble, looks and sounds good and is a nice play thing for the more experienced riders. It’s a head turner that's a pretty good commuter but can also leave the pavement behind.

2015 Ducati Scrambler Sixty2

The Popular Sport Bike - 2014 Yamaha YZF-R6 600cc $9,000

I don't need to say much about the iconic YZF-R6. I selected a 2014 R6 to appeal to sportbike riders. Yes, you can tell yourself it's a commuter but we know how you like to ride this machine and so do the underwriters.

2014 Yamaha R6

Your Tourer/Standard/High-Ender - 2014 Ducati Diavel Strada 1200cc for $14,895

As you can see, the Diavel Strada checks a lot of boxes and rightfully so, its inclusion is very strategic, it’s appeal varies. The Strada is the bike for returning riders, the bike for mature riders or first or second bike for the mid-lifers. It could arguably straddle a bike class or two.

2014 Ducati Diavel Strada

The Rarity! Litre Bike - 2009 Buell 1125R

The Buell is a larger displacement Sport bike with a powerful engine, you'll see few of these on the road. Ride this baby with care, you don't want to crash this machine. Spoiler alert, the R doesn't necessarily help with premiums.

2009 Buell 1125r

Bonus! The Clown Bike - 2017 Honda MSX 125 Grom $3,599

The Honda Grom is a small entry level bike that started a sub-culture of customization. It’s the personalized commuter suitable in city parks or basically wherever you want. Plus, when there's an opportunity to compare low displacement street bikes, I'd be remiss if I left out the Grom - it’s just so special.

2017 Honda Grom

The Premium Comparison

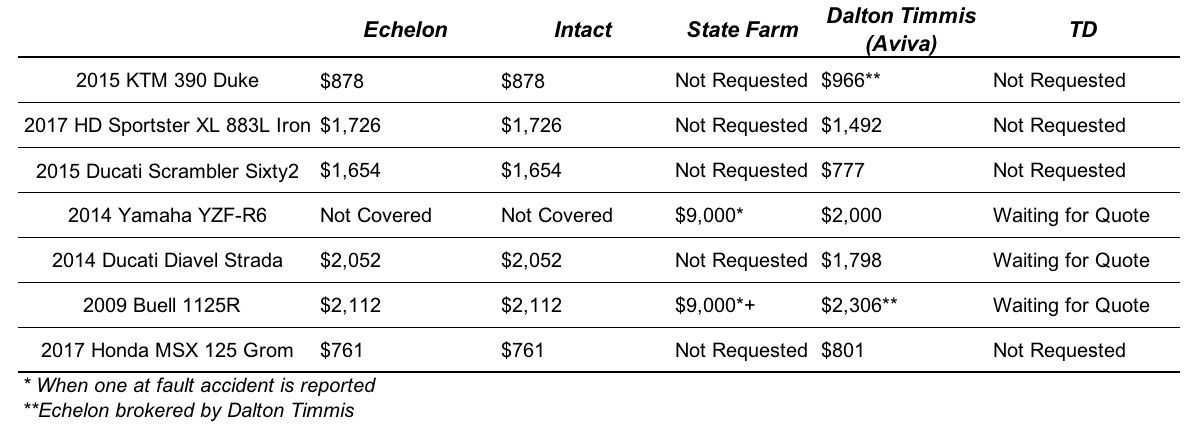

With premiums rising for all riders this comparison was based on a rider residing in Toronto, over the age of 30 with a full M unrestricted licence, riding for at least 5 years with no speeding tickets in the last 3 years, a clean record (or in some cases 1 accident in an automobile). The underwriters were Dalton Timmis brokering for Aviva, Echelon and Intact which seem to be the same; State Farm, and we're still waiting for TD.

2015 KTM 390 Duke is $878 at both Echelon and Intact. Dalton Timmis/Aviva cost is a bit higher at $966

2017 HD Sportster XL 883L Iron is $1,726 at both Echelon and Intact. Dalton Timmis/Aviva is significantly lower at $1,492

2015 Ducati Scrambler Sixty2 is $1,654 at both Echelon and Intact. Dalton Timmis/Aviva is much lower at $777

2014 Yamaha YZF-R6 is not covered at both Echelon and Intact. State Farm came in here at $9,000*, and Dalton Timmis/Aviva is dramatically lower at $2,000

2014 Ducati Diavel Strada is $2,052 at both Echelon and Intact. At Dalton Timmis/Aviva we see a cut in rate at $1,798

2009 Buell 1125R is $2,112 at both Echelon and Intact. State Farm is crazy at $9,000_+._ With Dalton Timmis/Aviva pricing is Echelon and higher at $2,306*

2017 Honda MSX 125 Grom is $761 which is the lowest price yet at both Echelon and Intact. With Dalton Timmis/Aviva we're looking at $801

2017 Motorcycle Insurance Premiums

*When one at fault accident is reported **Echelon brokered by Dalton Timmis

What Affects Your Rates?

As expected, motorcycles with lower displacement engines were quoted the lowest rates and the larger more powerful machines had the higher quoted premiums. Meanwhile, many underwriters simply exclude sport bikes over 600cc.

The logic is that the more powerful the machine, the more likely you are to lose control of it. Although it should come as no surprise that that larger displacement bikes cost more to insure.

Of the companies contacted, Dalton Timmis was the only underwriter to provide coverage for every motorcycle on the list. The other notable detail here is that most of the quoted premiums are higher than as recent as two riding seasons ago. Regardless of the size motorcycle you ride, it costs more to insure a motorcycle in 2017 than in previous years.

We're all fairly familiar with the factors that affect insurance premiums for automobiles but for motorcycles there are more criteria that affect your premiums and depending on which underwriter your consult, some have more weight than others.

Whether you've completed any rider training, how long you've had your licence, the level of graduated licence obtained are all important factors. The system that accounts for these factors is sophisticated, but in the end will actually reward all of these . The rate increases have impacted mature riders with clean motorcycle records, in fact for some companies, after the age of 55, your rates may increase because your range of motion and reaction times slow down, but this is true for auto insurance as well. Your car driving record matters too: having an accident in your automobile is seen as irresponsible and if you're at fault, the penalty is high. As you'd expect, a speeding ticket weighs heavily against you regardless of the vehicle you are operating.

Two other factors that are important are annual mileage you put on your bike and where you live. If you were to head 200 kilometres east of Toronto to Kingston ON, the prices (Intact and Echelon) tend to drop by about $300. In Toronto it would cost you $1726 to insure the HD Sportster 883L and in Kingston it would be $1,450 for the same rider. The premium for the Scrambler would drop to $1,300 from $1,654 and even the super sport Buell would see a the drop, you'd save $334. Across the board premiums usually drop for rural areas, but certain areas can have a surprising premium rating so it is not always a guarantee.

All this info goes back to the underwriters and your risk is calculated by factoring in the criteria above, your age, your home location, the number of that particular bike sold divided by the number of crashes and incidents that occurred by similar riders the previous year. Presto your premium is calculated.

Why Do Motorcycle Insurance Rates Increase?

There are more people buying and riding motorcycles in Ontario, last summer the industry grew 3% in Canada, which is good news. After the financial crisis of 2008 the motorcycle industry felt the conservatism of would be buyers; one of their major plays to rebuild revenue and excite the market resulted in producing small displacement bikes, lowering the barrier to entry and putting more riders in leathers.

Ontario saw a 14% increase in motorcycles between 2010 - 2017 and with more inexperienced riders, the amount of motorcycle claims rose too.

According to industry data from the Insurance Bureau of Canada, the average claim amount for a motorcycle accident in 2010 was $33,796 in 2014 it was already $51,074. This was a big problem for the insurance companies so they increased the premiums to gain more favourable margins. Speaking with Dalton Timmis Insurance broker David Gris, he recalled getting no less than 800 requests shortly after certain underwriters increased their premiums from policyholders shopping for better rates.

How To Lower Your Motorcycle Insurance Premium

The realities of insuring a motorcycle in Canada are worse than they've been but there's a number of things you can do lower your premium; some more effective than others. If you're the Hunter S. Thompson type, consider cutting your liability limit or completely drop your collision coverage. I'd like to mention that we (EatsleepRIDE), do not think this is a good idea.

Ontario Riding ...

You've probably heard of people cancelling their motorcycle insurance during the winter months, but cancelling your coverage in the winter doesn't typically yield sizeable returns; the premiums are prorated to the riding months. Continuous coverage is a factor weighted in the cost of your coverage so cancelling your bike insurance during the winter months is not a real option.

Consolidating your coverage so that your home, car (if you have one) and motorcycle are bundled with the same underwriter will greatly reduce your premium. If you're part of a group or professional association inquire about what group discounts options you may eligible for.

Lastly, and one of the most important things you can do to get a better rate on our insurance is to get a broker to shop your insurance around for you. They can utilize their network and collect every little detail that will help you get the best rate.

If you're out there using a broker and getting quotes you're likely reading other articles like this one. There is a lot of "dos" and "don't" out there. The factors affecting insurance rates are always changing and the quote you receive will be very specific to the information you provide. There are other criteria like as location, how much you ride.

According to Ian Harvey at the Toronto Star, motorcycle insurance rates are rising with severity due to the number of claims. The secret to getting the best insurance rate in Ontario is to be a safe rider. When we are more mindful at intersections, ride to excess only in controlled environments (racetracks), keep our eyes moving and help each other on the road, we'll be safer and premiums will be lower for all of us. Let's ride!

Editor's note: Getting the right insurance can be painful. We like the people at Dalton Timmis because they care about providing the best insurance price and promoting safety. For a limited time, EatSleepRIDE has partnered up with Dalton Timmis to offer riders a 3-months free subscription to CRASHLIGHT:registered: with every instant quote. For more info and to get your CRASHLIGHT coupon, go to http://daltontimmis.io/eatsleepride

You must be logged in to comment

Login now